Payroll Account Reconciliation

Payroll is frequently an inherent part of operating a business. Employees require to get paid; taxes and benefits must be considered and paid as well. Since payroll can be very complex and detailed, companies often decide to outsource this function, but they still require to book payroll in their accounting systems. Accounting for payroll typically involves numerous general ledger accounts to capture data about expenses and liabilities, including payroll payable and tax expense accounts.

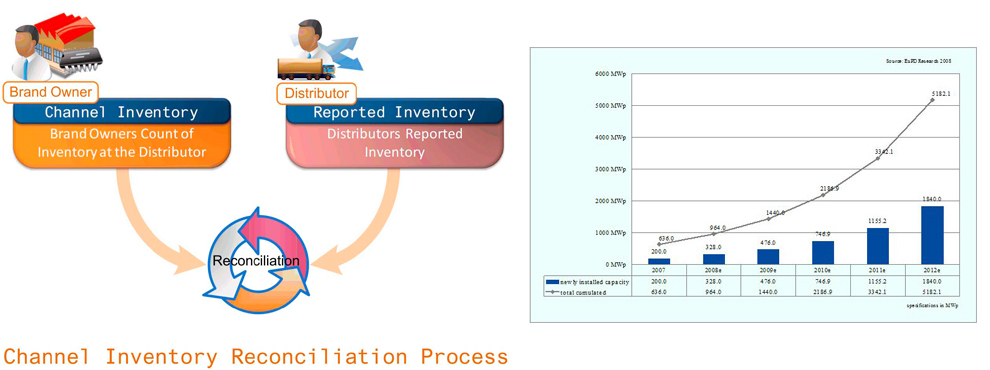

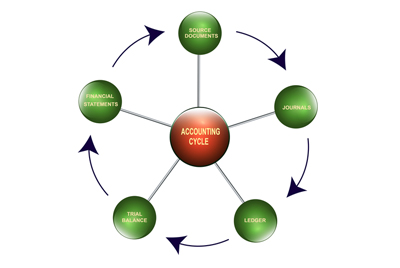

Collect your payroll statements and reports. To reconcile payroll accounts, you require to compare them to outside documentation. You can also get bank statements to confirm cash paid for payroll and taxes. Run a trial balance report on the particular payroll accounts you want to reconcile; balances must match with outside documentation. For instance, payroll liability per payroll report must agree with the liability in the general ledger. Any differences must be investigated --- most are due to mistakes in the general ledger area.

Get reports from your payroll module if you're running payroll in-house. Compare totals from module reports to balances in accounts in the general ledger. If module reports designate that your year-to-date payroll tax expense is $10,000, for instance, this amount must be the balance on your tax expense account. If not, then you require to investigate the reason for the inconsistency through looking at each individual month's expenses. The inconsistency could be due to a mapping problem in the payroll module, causing data to be posted in the incorrect accounts.

Regulate the general ledger for any differences and inconsistencies. This is typically the last step in reconciling payroll accounts. Subsequently the point of reconciliations is to guarantee that accounts' balances are correct, when mistakes or errors are found, regulate the accounts punctually. Make sure that the salaries expense account shows gross pay, and that the tax expense account imitates only employer's taxes not employees' withholding.

The main benefits of working with Reconciliationaccounting are below:

Consistent Data Source – Reconciliationaccounting business give you consist and precise data which can be easily used for the benefits of the decision-making desires. This in turn guarantees competence in workflow and there is no expenditure of time.

Maximize your ROI: Reconciliationaccounting work give significant cost reduction and gives you high Return of asset.

High Superiority Work – Main benefits of Reconciliationaccounting work is to get high quality work as per your needs with reasonable rates.

Securities, Uniformity, Rapid growth, Speed, services and improve customer satisfaction, improved presentation, Backend effective work environment these are main goal of Reconciliationaccounting.

We work 24/7 days for more details feel free to contact us at any time you required.