Creditor Reconciliation

At the end of each month a statement is received from creditors. The statement demonstrations the transactions that have taken place during the month. What does this tell us? It shows us the transactions that have taken place in that specific month. So it’s information that the creditor has sent us telling us about the transactions that have ensued in that particular month.  What do we do with this statement? We take the statement should be compared to the creditors ledger account to confirm that the details of all invoices and other transactions imitated on it are accurate before payment can be made. Why? Once we can confirm the correctness of that information we are now in the position to make the essential payments, so clearly we receive the statement, we confirm the accurateness and now we go on to make the payments.

What do we do with this statement? We take the statement should be compared to the creditors ledger account to confirm that the details of all invoices and other transactions imitated on it are accurate before payment can be made. Why? Once we can confirm the correctness of that information we are now in the position to make the essential payments, so clearly we receive the statement, we confirm the accurateness and now we go on to make the payments.

Methods to follow:

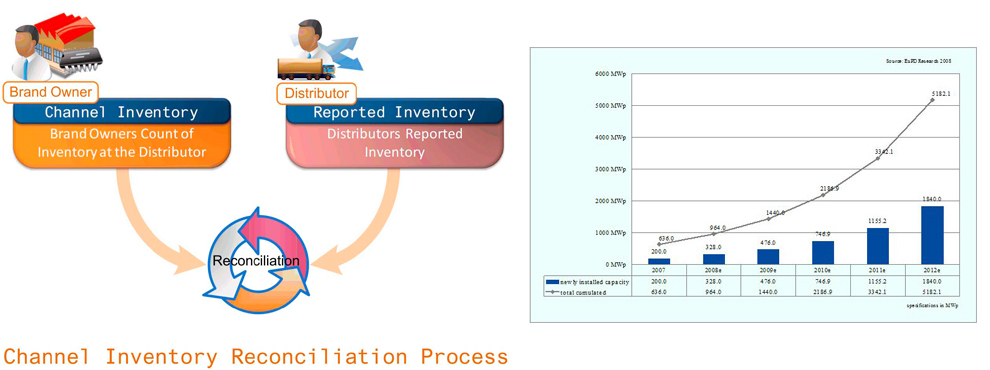

- Associate the monthly statement against the creditors ledger account in the Creditors Ledger. Remember that we have for each of our creditors a separate account in our subsidiary ledger namely the creditor’s ledger and there every account of every creditor appears.

- The debit column of the statement is associated to the credit side of the ledger account and the credit column on the statement is compared with the debit side of the ledger account. Can you recall? When you did the bank reconciliation statement same thing debit and credit, remember in your books it’s a creditor somebody you due money too. Whereas in their books you are a debtor, you owe money to them. Remember to understand the relationship we are talking about here.

- If there are any mistakes or omissions in the books of the business receiving the statement, they should be corrected. (It is significant to confirm the entry before recording). Important information, you have to confirm the entry before recording.

- If the creditor made any mistakes (arithmetical, omissions), the business receiving the statement should inform the creditor so that the necessary rectifications can be made through the creditor. They can attain at the correct balance through preparing a Creditors Reconciliation Statement. In today’s times it’s highly possible that mistakes can be made though we are using computers there is a possibility that a mistake can arise.

The main benefits of working with Reconciliationaccounting are below:

Consistent Data Source – Reconciliationaccounting business give you consist and precise data which can be easily used for the benefits of the decision-making desires. This in turn guarantees competence in workflow and there is no expenditure of time.

Maximize your ROI: Reconciliationaccounting work give significant cost reduction and gives you high Return of asset.

High Superiority Work – Main benefits of Reconciliationaccounting work is to get high quality work as per your needs with reasonable rates.

Securities, Uniformity, Rapid growth, Speed, services and improve customer satisfaction, improved presentation, Backend effective work environment these are main goal of Reconciliationaccounting.

We work 24/7 days for more details feel free to contact us at any time you required.