Accounts Reconciliation

Accounts Payable or AP are categorized as current liabilities and reported on the balance sheet. In order to close the books at month end and at year end Accounts Payable should be in reconcilement. This can be a very large account or a small one if you are a small business.

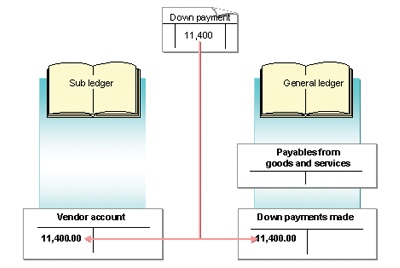

If your firm uses the Accrual Process of Accounting, it records expenses as they arise not when they are actually paid, then the payable account is used widely. Usually, firms use a general ledger balance (total sum) and a subsidiary balance (details of accounts) to record payable. Use these tips to assistance you reconcile the master Accounts Payable account and its records.

An accounts payable statement typically refers to an accounts payable control account. Reconciling an accounts payable statement is confirming that the accounts payable control account matches the accounts payable subsidiary accounts.

Accounts payable is an account used to track amounts that a firm owes. The control account shows a total of all money owed. Accounts payable subsidiary account is a breakdown of all amounts owed through who they are owed to. The amount in the control account must be equal to the total amount of all accounts payable subsidiary accounts.

To reconcile the accounts payable, the control account balance is required as well as the subsidiary account balances. The two amounts should balance. Another way of balancing this is to start with the beginning monthly balance of accounts payable. Add the total amounts purchased throughout the month and subtract any payments made on the account. This must also equal the ending balance in accounts payable. This amount is also confirmed with the subsidiary ledgers.

Accounts Receivable Reconciliation: Customer invoicing assistances businesses make more sales and gives customers more time to pay for their purchases. Numerous companies grant their customers short-term credit, delivering goods or facilities and giving the customer a set period of time to pay. The accounts receivable procedure tracks issued invoices and matches them with incoming payments. A company must manage its accounts receivable for correctness and quick payment as part of good overall cash flow management.

The accounts receivable asset account tracks payments due from customers for goods or services provided through a business. The provider typically stipulates a payment due date of 30 or 45 days, for instance. The company may also offer a discount for early payment, such as "1% 10 net 30", meaning the customer can reduce his balance payment through 10 percent if he pays within 10 days, or he can pay the full balance in 30 days.

Handling a profitable business needs knowledge of your current cash balances and the amount of cash you can expect to receive within the next 30 to 60 days. It is not adequate to rely on the accounts receivable balance in your accounting software -- errors do happen, and the business could have less cash coming in than the records show. To authenticate the accounts receivable information, accountants occasionally compare the information in the accounts receivable account to information contained in the check register and other documentation

The accountant should compare his spreadsheet data to the accounts receivable records, item by item. Any inconsistencies should be resolved. Common mistakes include transposed numbers on a check or invoice entry, a lost check that was recorded as received but never made it to the bank, or partial payments that were applied to the incorrect invoice or customer account.

The main benefits of working with Reconciliationaccounting are below:

Consistent Data Source – Reconciliationaccounting business give you consist and precise data which can be easily used for the benefits of the decision-making desires. This in turn guarantees competence in workflow and there is no expenditure of time.

Maximize your ROI: Reconciliationaccounting work give significant cost reduction and gives you high Return of asset.

High Superiority Work – Main benefits of Reconciliationaccounting work is to get high quality work as per your needs with reasonable rates.

Securities, Uniformity, Rapid growth, Speed, services and improve customer satisfaction, improved presentation, Backend effective work environment these are main goal of Reconciliationaccounting.

We work 24/7 days for more details feel free to contact us at any time you required.